Blockchain Devices Market is projected to grow from USD 482 million in 2021 to USD 2,459 million by 2026; it is expected to grow at a CAGR of 38.5% during the forecast period. The Growing visibility of benefits of blockchain technology in financial sector is providing growth for blockchain devices. Moreover, rapid development of blockchain technology in retail & supply chain management applications; Growth in cryptocurrency market capitalization and initial coin offering (ICO); and decentralized structure and various other attributes associated with blockchain technology plays a key role in driving the growth of the blockchain devices market.

Blockchain Devices Market is projected to grow from USD 482 million in 2021 to USD 2,459 million by 2026; it is expected to grow at a CAGR of 38.5% during the forecast period. The Growing visibility of benefits of blockchain technology in financial sector is providing growth for blockchain devices. Moreover, rapid development of blockchain technology in retail & supply chain management applications; Growth in cryptocurrency market capitalization and initial coin offering (ICO); and decentralized structure and various other attributes associated with blockchain technology plays a key role in driving the growth of the blockchain devices market.

Blockchain Devices Market Worth USD 2,459 Million by 2026

Some of the prominent key players are:Ledger (France),SatoshiLabs (Czech Republic),SIRIN LABS (Switzerland),Pundi X (Singapore),Genesis Coin (US),GENERAL BYTES (Czech Republic),HTC (Taiwan),RIDDLE&CODE (Austria),ShapeShift (UK),Bitaccess (Canada),Coinsource (US),Samsung (South Korea),Infineon Technologies (Germany),Helium Systems (US),AVADO (Switzerland),Lamassu Industries (Switzerland),Tangem (Switzerland),SafePal (China),PAYMYNT (US),Modum (Switzerland),NXM Labs (US).

Hardware wallets to hold the largest size of blockchain devices market during the forecast period

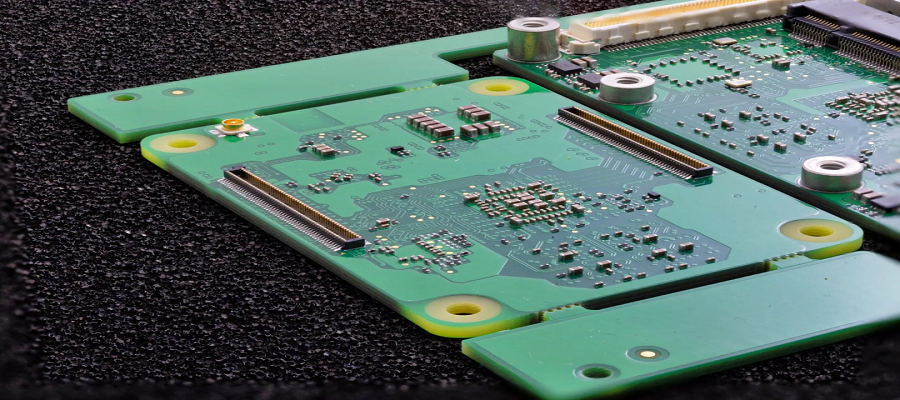

The hardware wallets segment is expected to dominate the blockchain devices market during the forecast period in terms of value as well as volume. This growth is attributed mainly due to the ability of hardware wallets to store the private keys of users without the risk of getting them exposed to malicious threats over the Internet. Hardware wallets are often referred to as cold storage because they are not connected to the Internet. When connected to a computer, a hardware wallet does not share the private keys with the computer or over the Internet. The only transaction that takes place between the hardware wallet and the computer is of an unsigned and signed contract. As a result, the private key remains secure in the hardware wallet. With the advent of cryptocurrencies, hardware wallets have become a critical requirement for crypto owners for safeguarding their private keys. Hence, security, ownership, and ease of use are expected to drive the market for hardware wallets from 2021 to 2026.

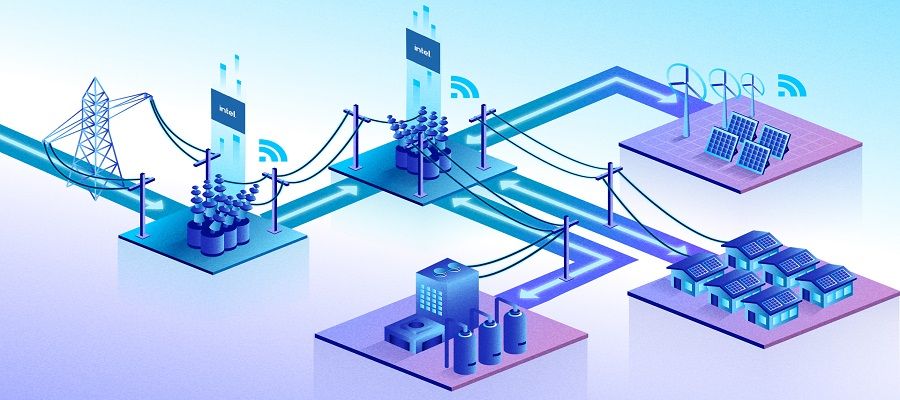

Market for wireless blockchain devices expected to grow at the highest rate during the forecast period

The wireless blockchain device segment is expected to grow at a higher CAGR during the forecast period. Wireless technologies, for instance, Bluetooth, NFC, and Wi-Fi are embedded in consumer electronic devices such as smartphones, laptops, and home appliances and are also used in payment machines, such as PoS devices and crypto ATMs. These technologies allow users to use portable blockchain devices such as hardware wallets, smart cards, and PoS devices to make a transaction by coordinating with other wireless devices. Hence, it is expected that hardware wallets would dominate the wireless blockchain devices market during the forecast period.

North America expected to dominate the blockchain devices market during the forecast period

North America is among the major contributors to the blockchain devices market, and the US accounted for the largest market share in 2020. The regional market growth is also driven by developments in blockchain devices, such as blockchain security and blockchain IoT gateways, by companies such as Genesis Coin (US), Bitaccess (Canada), Coinsource (US), PAYMYNT (US), Helium Systems (US), NXM Labs (US), Xage Security (US), GridPlus (US), NetObjex (US), and Coinkite (Canada). They provide blockchain devices and solutions to verticals such as BFSI, government, and retail & e-commerce, which held the largest shares of the global market in 2020. BFSI and government are among the fastest-growing verticals of the blockchain devices market, as the technology offers improved security and privacy and enables to perform fast transactions. For instance, in April 2021, Credit Suisse (Switzerland) collaborated with a Fintech startup Paxos (US) and, Nomura-owned broker-dealer company, Instinet (US), to execute the first blockchain-based settlement of the US equities