Apart from being a critical driver of economic growth, Foreign Direct Investment (FDI) has been a major non-debt financial resource for the economic development of India. Foreign companies invest in India to take advantage of relatively lower wages, special investment privileges like tax exemptions, etc. For a country where foreign investment is being made, it also means achieving technical know-how and generating employment.

The Indian Government’s favorable policy regime and robust business environment have ensured that foreign capital keeps flowing into the country. The Government has taken many initiatives in recent years such as relaxing FDI norms across sectors such as defense, PSU oil refineries, telecom, power exchanges, and stock exchanges, among others.

Market size

According to the Department for Promotion of Industry and Internal Trade (DPIIT), FDI equity inflow in India stood at US$ 521.47 billion between April 2000 and December 2020, indicating that the government’s efforts to improve ease of doing business and relaxing FDI norms have yield results.

FDI equity inflows in India stood at US$ 51.47 billion in 2020-21 (between April 2020 and December 2020). Data for 2020-21 indicates that the computer software and hardware sector attracted the highest FDI equity inflows of US$ 24.39 billion, followed by the construction (infrastructure) activities (US$ 7.15 billion), service sector (US$ 3.86 billion), and trading (US$ 2.14 billion).

In 2020-21 (between April 2020 and December 2020), India received the highest FDI equity inflows from Singapore (US$ 15.72 billion), followed by the US (US$ 12.83 billion), the UAE (US$ 3.92 billion), Mauritius (US$ 3.48 billion), Cayman Islands (US$ 2.53 billion), the Netherlands (US$ 2.44 billion) and the UK (US$ 1.83 billion).

In 2020-21 (between April 2020 and December 2020), Gujarat received the highest FDI equity inflows of US$ 21.24 billion, followed by Maharashtra (US$ 13.64 billion), Karnataka (US$ 6.37 billion), and Delhi (US$ 4.22 billion).

Investments/ Developments

Some of the significant FDI announcements made recently are as follows:

- In the first nine months of FY21, total FDI inflows amounted to US$ 67.54 billion, a 22% YoY increase.

- In February 2021, Amazon announced to start manufacturing electronic devices in India from 2021

- In January 2021, Amazon partnered with Startup India, Sequoia Capital India and Fireside Ventures to launch an accelerator programme to support early-stage start-ups take their brands to international markets and boost domestic exports.

- In November 2020, Rs. 2,480 crore (US$ 337.53 million) foreign direct investment (FDI) in ATC Telecom Infra Pvt Ltd. was approved by the Union Cabinet.

- In November 2020, Amazon Web Services (AWS) announced to invest US$ 2.77 billion (Rs. 20,761 crore) in Telangana to set up multiple data centres; this is the largest FDI in the history of the state.

- Since April 2020, the government has received over 120 foreign direct investment (FDI) proposals worth ~Rs. 12,000 crore (US$ 1.63 billion) from China. Between April 2000 and September 2020, India received US$ 2.43 billion FDI from China.

- According to the Reserve Bank of India (RBI), India’s Outward Foreign Direct Investments (OFDIs) in equity, loan and guaranteed issue stood at ~US$ 1.85 billion in February 2021 vs. US$ 1.19 billion in January 2021.

Government Initiatives

In March 2021, the parliament approved a bill to increase foreign direct investment (FDI) in the insurance sector from 49% to 74%.

In March 2021, Mr. Shripad Naik, the Minister of State for Defence, stated that a total of 44 Indian companies, including public sector units, have received approvals related to FDI for joint production of defense items with foreign organizations.

In December 2020, the government of Uttar Pradesh agreed to provide Samsung Display Noida Private Limited with special incentives to set up a mobile and IT display product manufacturing unit. Under the Central Government’s scheme for the promotion of manufacturing electronic components and semiconductors (SPECS), Samsung will also receive a financial incentive of Rs. 460 crore (US$ 62.61 million). This project will develop a global export hub in Uttar Pradesh and will help the state attract more foreign direct investments (FDI).

In December 2020, changes in the guidelines for the provision of Direct-to-Home (DTH) services have been approved by the Union Cabinet, enabling 100% FDI in the DTH broadcasting services market.

Road ahead

India is expected to attract foreign direct investments (FDI) of US$ 120-160 billion per year by 2025, according to CII and EY report. Over the past 10 years, the country witnessed a 6.8% rise in GDP with FDI increasing to GDP at 1.8%.

In terms of attractiveness, investors ranked India #3; ~80% of investors have plans to invest in India in the next 2-3 years, while ~25% reported investments worth >US$ 500 million

India attracted the highest ever total FDI inflow of US$ 81.72 billion during 2020-21, 10% more than the last financial year

Measures were taken by the Government on the fronts of Foreign Direct Investment (FDI) policy reforms, investment facilitation, and ease of doing business have resulted in increased FDI inflows into the country. The following trends in India’s Foreign Direct Investment are an endorsement of its status as a preferred investment destination amongst global investors:

- India has attracted highest ever total FDI inflow of US$ 81.72 billion during the financial year 2020-21 and it is 10% higher as compared to the last financial year 2019-20 (US$ 74.39 billion).

- FDI equity inflow grew by 19% in the F.Y. 2020-21 (US$ 59.64 billion) compared to the previous year F.Y. 2019-20 (US$ 49.98 billion). In terms of top investor countries, ‘Singapore’ is at the apex with 29%, followed by the U.S.A (23%) and Mauritius (9%) for the F.Y. 2020-21.

- ‘Computer Software & Hardware’ has emerged as the top sector during F.Y. 2020-21 with around 44% share of the total FDI Equity inflow followed by Construction (Infrastructure) Activities (13%) and Services Sector (8%) respectively.

- Under the sector `Computer Software & Hardware’, the major recipient states are Gujarat (78%), Karnataka (9%) and Delhi (5%) in F.Y. 2020-21.

- Gujarat is the top recipient state during the F.Y. 2020-21 with 37% share of the total FDI Equity inflows followed by Maharashtra (27%) and Karnataka (13%).

- Majority of the equity inflow of Gujarat has been reported in the sectors `Computer Software & Hardware’ (94%) and `Construction (Infrastructure) Activities’ (2%) during the F.Y. 2020-21.

- The major sectors, namely Construction (Infrastructure) Activities, Computer Software & Hardware, Rubber Goods, Retail Trading, Drugs & Pharmaceuticals and Electrical Equipment have recorded more than 100% jump in equity during the F.Y. 2020-21 as compared to the previous year.

- Out of top 10 countries, Saudi Arabia is the top investor in terms of percentage increase during F.Y. 2020-21. It invested US$ 2816.08 million in comparison to US$ 89.93 million reported in the previous financial year.

- 227% and 44% increase recorded in FDI equity inflow from the USA & the UK respectively, during the F.Y. 2020-21 compared to F.Y.2019-20.

Investment in India

Over the years, India has emerged as one of the fastest-growing economies in the world and an attractive investment destination driven by economic reforms and a large consumption base. India’s real gross domestic product (GDP) at current prices stood at Rs. 195.86 lakh crore (US$ 2.71 trillion) in FY21, as per the second advance estimates (SAE) for 2020-21. Simultaneously, the per capita income at current prices was estimated at Rs. Rs. 127,768 (US$ 1,765.43) in FY21.

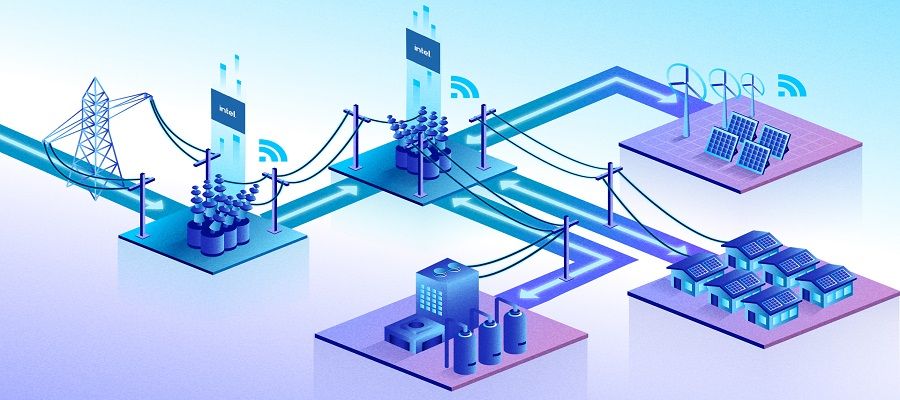

In a country like India, the seven major infrastructural factors that are most significant in accelerating the pace of economic development are: energy, transport, irrigation, finance, communication, education, and health. The first five refer to economic infrastructural facilities, while the latter two relate to social infrastructure.

India has the second-largest road network in the world, spanning a total of 5.5 million kilometers (kms).

With a generation of 1,561 terawatt-hours (TWh), India is the third-largest producer and the third-largest consumer of electricity in the world. As of February 2021, India had a total installed power generation capacity of 379,130.41 MW, of which 96,186.93 MW was contributed by central utilities, 103,628.39 MW (state utilities), and 179,315.10 MW (private utilities).

The Indian banking system consists of 20 public sector banks, 22 private sector banks, 44 foreign banks, 44 regional rural banks, 1,542 urban cooperative banks, and 94,384 rural cooperative banks in addition to cooperative credit institutions. As of September 2020, the ATM industry in India increased to ~2.5 lakh ATMs. Debit cards in India doubled to 86 crore in September 2020, of which ~30% (i.e., 30 crores) are RuPay cards issued to the PM Jan Dhan Yojana accounts.

A host of factors has enabled this growth, which includes a highly developed financial system, infrastructure requirement, and proactive Government initiatives. Domestic and foreign investment has made an impact on the country’s growth.

Recent Developments/Investments

- In March 2021, the Ministry of Electronics and IT (MeitY) invited applications for the second round of large-scale electronics manufacturing under the production-linked incentive (PLI) scheme. The application window for the scheme has been opened until March 31, 2021, which could be further extended in accordance with the guidelines issued by the MeitY (Ministry of Electronics and IT).

- In March 2021, the Ministry of Electronics and Information Technology (MeitY) has requested expressions of interest (EoIs) from organisations interested in establishing LCD/OLED/AMOLED/QLED-based display fabrication units in India.

- India’s overall exports from April 2020 to February 2021 were estimated at US$ 439.64 billion, a 10.14% YoY decrease. Overall imports from April 2020 to February 2021 were estimated at US$ 447.44 billion (a 20.83% YoY decrease).

- As of March 10, 2021, foreign portfolio investment inflows into equities stood at US$ 36 billion in FY21.

- The Private Equity – Venture Capital (PE-VC) sector recorded investments worth US$ 47.6 billion across 921 deals in 2020. This growth was mainly attributed to fundraising by Jio Platforms and Reliance Retail (i.e., investments worth US$ 17.3 billion, accounting for 36% of all PE/VC investments in 2020).

- In February 2021, gross tax revenue stood at Rs. 113,143 crore (US$ 15.58 billion).

- In 2020, merger and acquisition (M&A) activities increased by 33% to US$ 36.9 billion.

- To enhance funding for infrastructure and real estate, the finance bill proposed amendments (under the Union Budget 2021-22) to allow foreign portfolio investors (FPIs) to participate in debt financing of emerging investment vehicles such as REITs and InvITs.

- The Securities and Exchange Board of India (SEBI) directed stamp duty on alternative investment funds (AIFs), effective from July 1, 2020.

- In November 2020, assets managed by mutual funds reached Rs. 29.83 trillion (US$ 407.52 billion).

- In December 2020, Coal India announced to invest Rs. 3,370 crore (US$ 460.39 million) to develop 21 railway sidings to transport coal.

Road Ahead

India is presently known as one of the most important players in the global economic landscape. The country is at a fast pace of growth and is expected to become a US$ 5 trillion economy by 2022. Going by the estimates of the Government of India, the country will need an investment of US$ 4.5 trillion to build sustainable infrastructure by 2040. The Union Budget 2021-22 highlights a 34.5% increase in capital expenditure—Rs. 142,151 crore (US$ 19.58 billion)—compared with BE 2020-21 to boost economic growth through infrastructure development. Increased government investment is expected to attract private investments, coupled with the government’s key Production-linked Incentive Scheme providing significant support.

A positive agricultural outlook remains a significant lever for revitalizing rural demand and accelerating consumption. The Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS) has generated 350 crore individual days of jobs as of February 28, 2021, a substantial increase of 41.6% over FY20. The agricultural sector’s growth will be supported even further by the Union Budget 2021-22, driven by increased investments in rural infrastructure, highways, and agriculture infrastructure, as well as a strong drive for fisheries and seaweed production, and increased credit flow to allied industries.

India’s real GDP growth for FY22 is projected at 11%, according to the Economic Survey 2020-21. The WEO January 2021 forecasts an 11.5% increase in FY22 and a 6.8% rise in FY23. According to the IMF, India is also expected to emerge as the fastest-growing economy in the next two years.

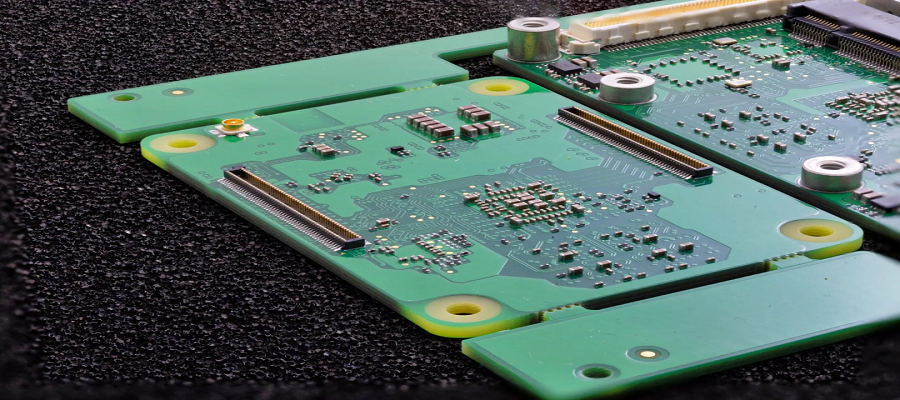

Nineteen companies filed their applications under the PLI scheme for IT Hardware

A total of 19 companies have filed their application under the Production Linked Incentive Scheme (PLI) for IT Hardware which was notified on 03.03.2021. The scheme was open for filing applications till 30.04.2021. Incentives are applicable under the scheme from 01.04.2021.

The electronics hardware manufacturing companies that have applied under the category IT Hardware Companies are Dell, ICT (Wistron), Flextronics, Rising Stars Hi-Tech (Foxconn), and Lava.

14 companies have filed applications under the category Domestic Companies which include Dixon, Info power (JV of Sahasra and MiTAC), Bhagwati (Micromax), Syrma, Orbic, Neolync, Optiemus, Netweb, VVDN, Smile Electronics, Panache Digilife, HLBS, RDP Workstations, and Colonics. These companies are expected to expand their manufacturing operations in a significant manner and grow into national champion companies in IT Hardware production.

Production Linked Incentive Scheme (PLI) for IT Hardware was notified on 03.03.2021. The PLI Scheme extends an incentive of 4% to 2%/ 1% on net incremental sales (over the base year of FY 2019-20) of goods under target segments that are manufactured in India to eligible companies, for a period of four years (FY 2021-22 to FY 2024-25).

In his address marking the conclusion of the application window under the scheme, Mr. Ravi Shankar Prasad, Union Minister for Electronics & IT, Communications, Law, and Justice said that the PLI scheme for IT Hardware has been a huge success in terms of the applications received from Global as well as Domestic companies engaged in manufacturing electronics hardware products. The industry has reposed its faith in India’s stellar progress as a world-class manufacturing destination and this resonates strongly with Prime Minister’s clarion call of Atmanirbhar Bharat – a self-reliant India. The Minister further said that “we are optimistic and looking forward to building a strong ecosystem across the value chain and integrating with the global value chains, thereby strengthening electronics manufacturing ecosystem in the country”.

Under the leadership of Prime Minister Mr. Narendra Modi and his visionary initiatives like the “Digital India” and “Make in India” programmes, India has witnessed unprecedented growth in electronics manufacturing in the last five years. The National Policy on Electronics 2019 envisions positioning India as a global hub for Electronics System Design and Manufacturing (ESDM) by focusing on size and scale, promoting exports, and enhancing domestic value addition by creating an enabling environment for the industry to compete globally.

After the success of the Production Linked Incentive Scheme in bringing investments in mobile phone (handsets and components) manufacturing, the Union Cabinet chaired by the Prime Minister, Mr. Narendra Modi has approved the Production Linked Incentive (PLI) Scheme for IT hardware products. The target IT hardware segments under the proposed Scheme include Laptops, Tablets, All-in-One Personal Computers (PCs), and Servers. The scheme proposes production-linked incentives to boost domestic manufacturing and attract large investments in the value chain of these IT Hardware products.

Over the next 4 years, the Scheme is expected to lead to a total production of about INR 1,60,000 crore. Out of the total production, IT Hardware companies have proposed production of over INR 1,35,000 crore, and Domestic Companies have proposed a production of over INR 25,000 crore.

The scheme is expected to promote exports significantly. Out of the total production of INR 1,60,000 crore in the next 4 years, more than 37% will be contributed by exports of the order of INR 60,000 crore.

The scheme will bring additional investment in electronics manufacturing to the tune of INR 2,350 crore.

The scheme will generate approximately 37,500 direct employment opportunities in the next 4 years along with creation of additional indirect employment of nearly 3 times the direct employment.

Domestic Value Addition is expected to grow from the current 5-12% to 16-35%.

With the demand for electronics in India expected to grow manifold by 2025, the Union Minister expressed confidence that the PLI scheme and other initiatives to promote electronics manufacturing will help in making India a competitive destination for electronics manufacturing and give boost to Atmanirbhar Bharat. Creation of domestic champion companies in electronics manufacturing under the Scheme will give fillip to vocal for local while aiming for global scale.

Tesla in talks with India’s Tata Power for EV charging infrastructure

According to CNBC-TV18, which further cited sources, Tesla Inc. is exploring to partner with Tata Sons’ power generation unit, Tata Power, to set up charging infrastructure for electric vehicles in India.

After the statement, Tata Power shares rose 5.5% to their highest closing level since June 9, 2014. The news comes as the Palo Alto-based electric-car manufacturer expects to launch in India later in 2021, including plans to import and market its Model 3 electric sedan.

According to a government document seen by Reuters, Tesla will establish an electric-car manufacturing facility in the Indian state of Karnataka.

The discussions between Tata Power and Tesla are still in the early stages, according to the article, and no agreements have been made yet. The two companies did not respond to requests for comment immediately.

Tesla Motors India and Energy Private Ltd were established in January 2021, with its registered office in Bengaluru, a hub for global technology companies.

Tata Motors Ltd., the Tata Sons carmaker, denied any association with Tesla last week after media reports indicated that the two firms were evaluating a collaboration.